The Accounting Industry: Challenges & Opportunities in 2023

Accounting, a profession steeped in tradition and principles, has been undergoing a remarkable transformation in 2023. With the advent of technology and shifting client expectations, accountants and bookkeepers are encountering a series of challenges that demand innovative solutions. To shed light on the current accounting landscape and the significant challenges accountants face, Cradle spoke with Xero’s Executive General Manager of Technology Strategy and Integration, James Bergin.

Waves of innovation

"When you think about emerging technologies that are coming in, A.I. is the next big one to watch as it's rapidly evolving and changing the way we work. But there’s actually been three waves of innovation that have changed the landscape.”

With nearly two decades in financial services and fintech, James Bergin knows a thing or two about rapid change of technology in the sector.

“The first wave was really moving accounting to the cloud, so rather than just being tied to your desk, we saw people starting to change their systems a number of years ago. Now it’s really accelerating,” says James.

That acceleration started for many businesses when the pandemic hit.

“If you couldn’t physically get into your office, it was quite useful to be able to access the capabilities you need from wherever you are in the world.”

While society becoming more digitised has seen some things become easier, some aspects have also become harder.

“There are no solutions to problems, there’s just trade-offs. We’ve become more digitalised and that makes aspects of compliance easier and more automated. But we’re also seeing an increasing amount of mandating digitalisation from governments,” says James, who adds it’s left accountants navigating a new digital landscape while trying to stay compliant.

New software capabilities, according to James, are becoming increasingly significant in how all businesses tasks get done, marking the second wave of innovation.

“If you’re starting or running a business, you’re generally not looking as much to build your own solutions - rather you’re looking to leverage capabilities that are already available. But in the last four years, this approach has become even more accelerated and amplified - it's not just the kind of techy hip companies that are doing it, it’s everyone who has started to recognise that if they’re not leveraging their capabilities off the cloud, then they’re going to get left behind,” he says.

Because of this, James says customers are expecting different solutions and platforms to connect and integrate with each other, and from this we’re seeing more financial tasks being embedded into different platforms.

“As for the third, well this comes back to A.I. The insights different types of A.I. have already unlocked have been huge, the opportunity for automation is forever growing and this leads to the removal of toil which is taking work efficiency to a new level. Generative A.I. has been hyped up over the last year, but even beyond the hype, the actual technology underpinning it is starting to really have its moment. As A.I. gets integrated into more products a and features, we will see greater optionality and hyper-personalised insights that can anticipate and predict customer’s needs”

But that moment hasn’t come without challenges.

Challenges and biggest problems being faced

Recently Xero conducted the Future Focus AI research of more than 3000 small businesses globally, many of whom were accountants and consider themselves to be small businesses.

“When you start realising that many accountants and bookkeepers are small businesses themselves, they have some of the same concerns and fears; they kind of get hit twice because they have the same fears and concerns or questions that small businesses have and then they have the role of trying to help and advise small businesses,” he says.

A big concern for these small accounting businesses is understanding all this new innovation and emerging technology, and knowing which services would work best for their business.

Xero’s A.I. research found that four in five small businesses are concerned that AI development and adoption is outpacing regulation. However, despite these concerns, two-thirds of them said they were proactively looking for ways to use A.I. But they did tell Xero there was a clear desire for greater education and support, with almost half (43%) feeling that training and resources on different types of A.I. and its impact is needed.

In response to this call for more education, Xero has published the Future Focus: AI Guide for Accountants and Bookkeepers to help them navigate the impact of A.I. on their practices and clients. The Guide cuts through the hype and fear-mongering and answers a really simple question: what does A.I. mean for your typical practice? How can A.I. assist and what are the watch-outs and risks to consider?

“These technologies are coming at us all thick and fast and if you’re day to day just doing the best you can as an accountant, how do you learn how to use things like A.I. to increase productivity?” says James.

Human vs robot

Given the abundance of new systems and services readily accessible, it raises the question “what remains of an accountant's role?”

James says there is one thing that can never be automated: trust.

“If I have an algorithm that automates a lot of tasks that were previously manual, great. For example, talking to a robot about whether or not a certain expense can be claimed. But in the context of what I’m trying to do to better my business, am I going to trust that I can ask an algorithm and they will know everything about me?” says James.

James notes that while manual tasks have been augmented, the role of accountants has evolved into something of great significance - being a key advisor to a small business.

In the modern landscape of accounting, the augmentation of manual tasks through automation and technology has ushered in a transformative era. Accountants are not confined to routine number crunching data entry. It has evolved into something far more significant to clients - a greater role in advising.

Beyond traditional bookkeeping, accountants now offer valuable insights, strategic guidance and a deeper understanding of their clients’ financial well-being.

“Despite automation, the fundamental human element of trust remains indispensable. Clients desire accountants they can talk to and rely on to better their business. Trust, empathy and a good relationship will continue to be at the heart of the accountant's role.”

Share this

You May Also Like

These Related Stories

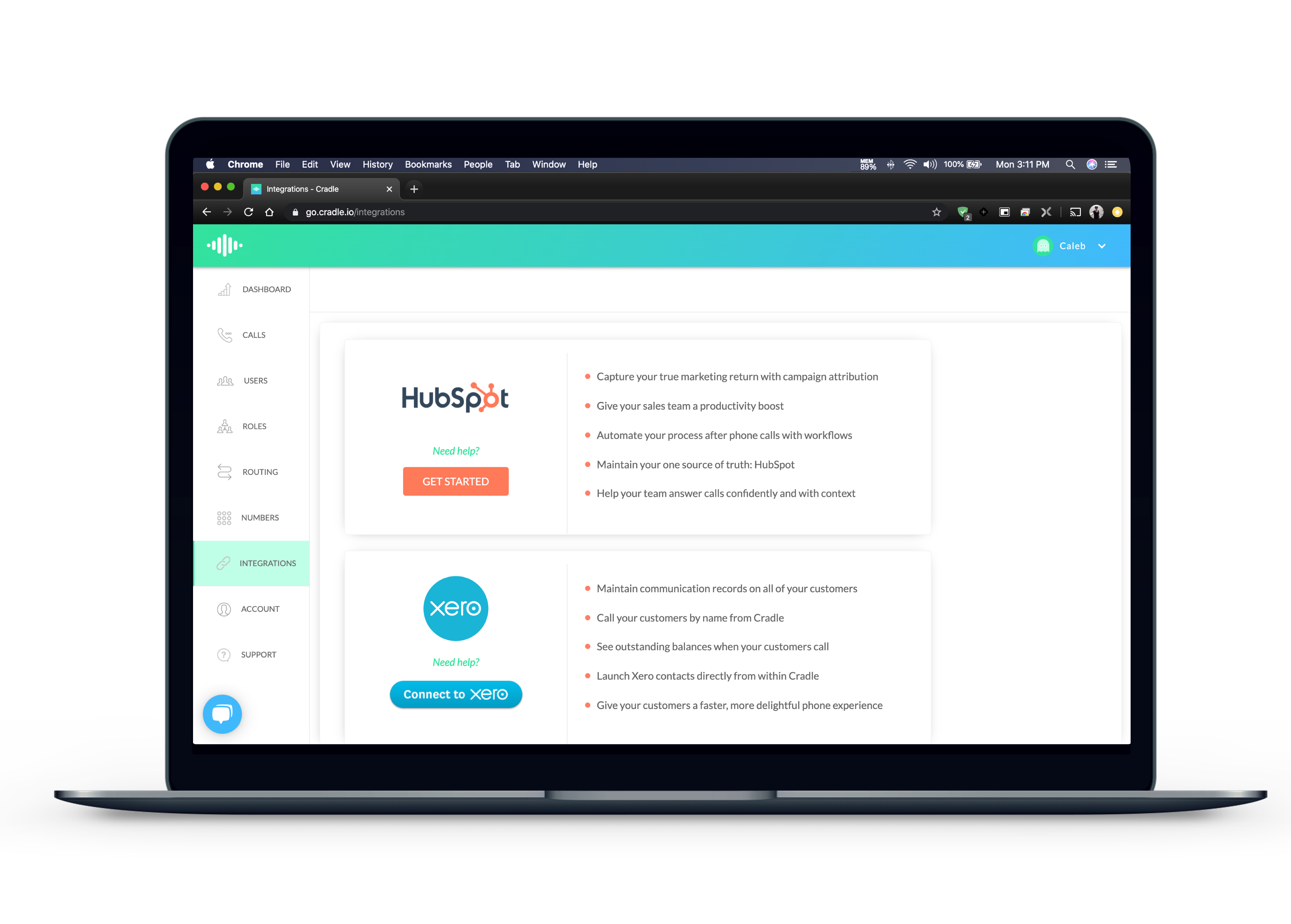

Xero and Cradle: accounting the RightWay

Cradle Wins Xero Award for the Human Touch